Digital Intelligence

Empowering Businesses with Intelligent Customer Lifecycle Management

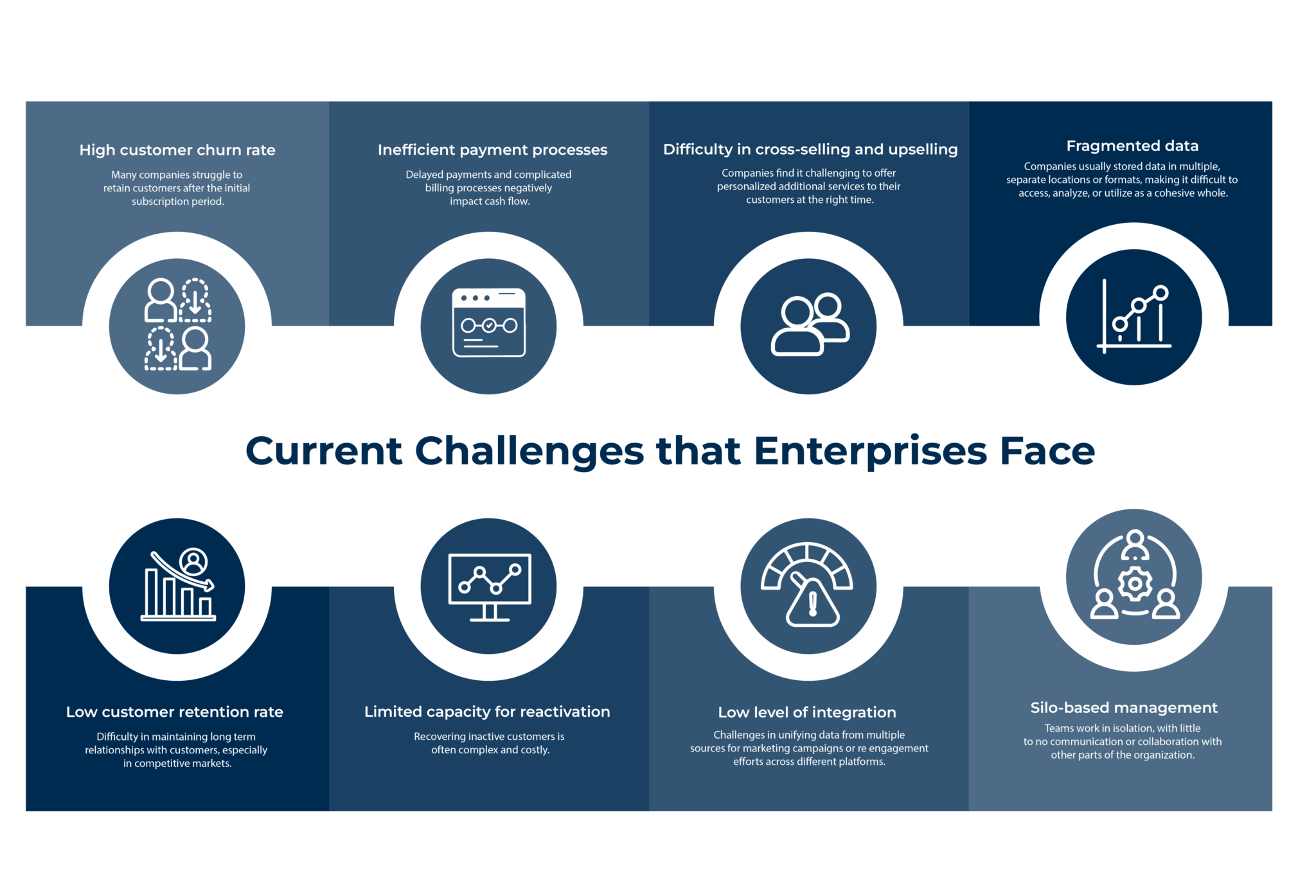

Our Why

We believe that success in business starts with a deep understanding of the customer lifecycle. Our mission is to empower companies by providing tools that allow them to make informed decisions, maximizing customer value and fostering long-term relationships.

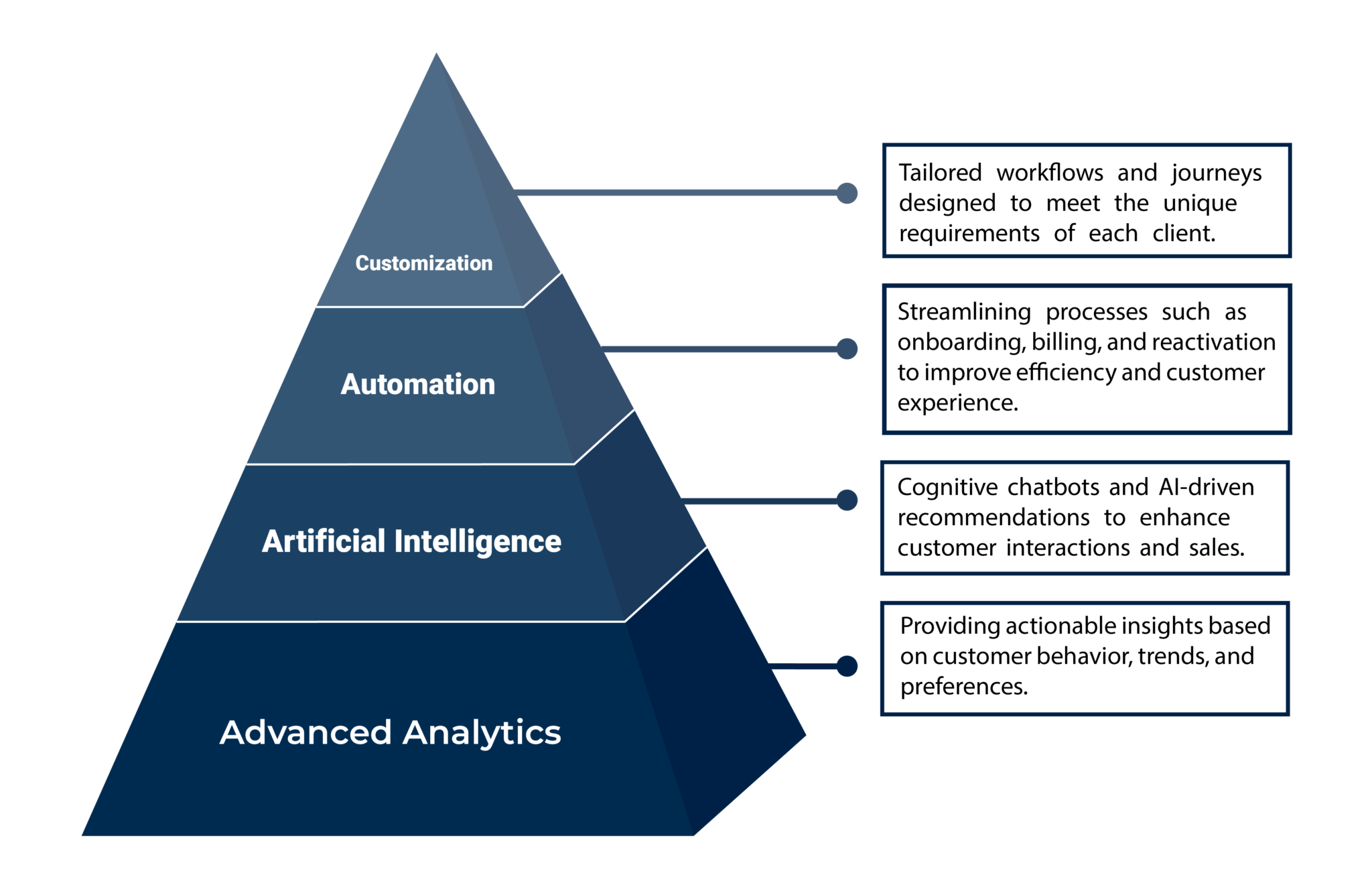

How We Do It

Through a combination of advanced analytics, artificial intelligence, and automation, we provide personalized solutions tailored to the unique needs of each business. Our platform seamlessly connects customer data, enabling smarter, faster, and more efficient decision-making across the entire lifecycle.

What We Aim For

We strive to lead the way in subscription-based business solutions by integrating intelligent customer lifecycle management with cutting-edge technology. Our goal is to help companies drive sustainable growth, improve customer retention, and optimize every stage of the customer journey.

Our Solution

A comprehensive SaaS platform that manages the entire customer lifecycle: from admission, growth, and collections, to retention and reactivation. Our solution integrates advanced analytics, cognitive chatbots, and automated sales processes to help companies optimize every stage of their customer relationships.

Our CLM Solution

Growth through Intelligent Sales

Uses cognitive chatbots to automate sales and lead qualification, prioritizing leads with the highest conversion potential.

Admission and Onboarding

Simplifies the registration process and personalizes the client’s experience from the first contact.

Loyalty and Retention

Personalized loyalty programs and advanced analytics to predict cancellations and take proactive measures.

Efficient Collections

Sends automatic payment reminders and uses predictive analytics to minimize delinquency and optimize cash flow.

Reactivation of Inactive Clients

Automates re-engagement campaigns and tracks the reasons behind client cancellations to recover lost value.

Customer Journey

Engaging potential customers through automated interactions and cognitive chatbots.

Personalized onboarding that streamlines the registration process and ensures a smooth start for the customer.

Regular communication and intelligent sales strategies (upselling/cross-selling) driven by customer behavior analytics.

Automated payment reminders and predictive analytics to reduce delinquency and improve cash flow.

Proactive measures to maintain customer satisfaction and loyalty, including personalized retention strategies.

Automated reactivation campaigns to win back inactive or churned customers, using data-driven insights.

How We Do It

Tangible Results

Our advanced retention strategies and predictive analytics help companies keep more customers for longer periods.

Intelligent upselling and cross-selling recommendations powered by AI lead to higher customer lifetime value.

Automated payment reminders and collections analytics improve cash flow and reduce late payments.

Our cognitive chatbots and automated sales processes increase the efficiency of sales teams, converting more leads into paying customers.

Data-driven reactivation campaigns and personalized outreach have proven highly effective at bringing back customers who had previously churned.

Implementation Stages

Collecting initial data requirements and setting up the foundation for integration. Assessing company needs and tailoring the platform to specific business objectives.

Seamless integration of customer, financial, and operational data into the platform. Connecting with existing systems (CRMs, billing systems) to centralize customer information.

Centralizing and organizing data to ensure consistency and readiness for analysis. Creating a unified data warehouse to house all structured and unstructured data.

Deploying advanced analytics to generate actionable insights. Providing businesses with dashboards, customer segmentations, and predictive models.

Implementing the first round of data-driven decisions and automated workflows. Using insights to drive reactivation campaigns, optimize onboarding, and enhance retention.

Optimizing the platform to meet growing demands and ensure long-term success. Expanding the platform’s reach across all customer touchpoints and fine-tuning processes.

Key Performance Indicators (KPIs)

1. Admission / Onboarding

- Conversion Rate: Percentage of potential customers successfully onboarded.

- Onboarding Time: The average time it takes for a new customer to complete the onboarding process.

2. Growth

- Upsell/Cross-sell Rate: Percentage of customers purchasing additional services or products.

- Average Revenue per User (ARPU): Growth in revenue generated per customer.

3. Collections

- On-time Payment Rate: Percentage of customers who pay on time.

- Delinquency Rate: Reduction in the percentage of customers with overdue payments.

4. Retention

- Customer Retention Rate: Percentage of customers retained over a set period.

- Customer Lifetime Value (CLV): Total expected revenue from a customer over their entire relationship with the company.

5. Reactivation

- Reactivation Success Rate: Percentage of previously inactive or churned customers re-engaged and returning to the service.

- Cost of Reactivation: The average cost to recover an inactive customer versus acquiring a new one.

6. Sales Automation

- Lead Conversion Rate: Improvement in the percentage of leads converted into paying customers through automated processes.

- Chatbot Engagement Rate: The percentage of customer interactions handled by cognitive chatbots.

Success Stories

Client:

A leading financial services company was struggling with high delinquency rates that negatively impacted their cash flow and operational efficiency.

Challenge:

The company’s manual collections process was inefficient, with late payments piling up and leading to increased costs and customer dissatisfaction.

Solution:

By implementing our automated collections solution, we helped streamline their payment reminders, introduced predictive analytics to anticipate late payments, and provided multiple payment options for customers.

Results:

Within six months, the company saw a 15% reduction in delinquency rates, improving cash flow and reducing the cost of managing late payments.

Client:

A subscription-based service company with a high customer churn rate, particularly after the initial subscription period, was facing challenges in maintaining long-term relationships with their customers.

Challenge:

Customers were leaving after their initial term, with few efforts in place to understand or address the reasons for cancellations.

Solution:

We deployed our predictive analytics platform, which identified customers at risk of churn. This enabled the client to take proactive measures, such as targeted loyalty programs, personalized offers, and customer support outreach, to address potential issues before customers left.

Results:

The company achieved a 25% increase in customer retention within the first year, successfully extending customer lifetimes and boosting overall revenue.

Client:

A telecommunications company was losing a significant portion of its customer base each year due to high churn rates. These lost customers represented a large amount of missed revenue.

Challenge:

The company lacked an effective strategy for re-engaging churned customers and faced high costs when trying to win them back.

Solution:

Using our data-driven reactivation campaigns, we created personalized outreach efforts for previously lost customers. This included offering tailored promotions, addressing past pain points through feedback, and communicating new service improvements.

Results:

The company successfully reactivated 30% of its previously churned customers, turning lost revenue into regained business and enhancing customer loyalty moving forward.

Our Differentiator

Complete Lifecycle Coverage

Unlike other solutions that focus on only a single part of the customer lifecycle, our platform manages every stage—from acquisition to reactivation. This end-to-end approach maximizes customer value at every touchpoint and provides a seamless, integrated experience for businesses.

Cutting-Edge Solutions

We leverage advanced technologies such as artificial intelligence, machine learning, and predictive analytics to enhance customer engagement, retention, and reactivation. Our platform is designed to stay ahead of the curve with continuous innovation, helping businesses adapt to ever-evolving market demands.

Experienced Leadership

Backed by over 20 years of experience in management, strategy, AI, and data & analytics, our founders have a proven track record of driving growth and transformation in leading market companies and international consultancies. Their expertise ensures that the platform is both innovative and strategically sound.

Flexibility of a SaaS Solution

With a cloud-based SaaS model, our platform is fully scalable and adaptable to businesses of any size, offering easy integration with existing systems, regular updates, and the ability to customize features to fit unique business needs. This flexibility minimizes infrastructure investment and provides ongoing access to the latest features and improvements.

The Future of Customer Lifecycle Management (CLM)

Redefining Customer Relationships

Our goal is to continuously evolve how companies interact with their customers, using artificial intelligence and machine learning to enhance each stage of the customer lifecycle.

Seamless Data Integration

We envision a future where all customer touchpoints are interconnected, allowing for seamless data sharing across platforms and providing companies with a 360-degree view of their customers in real time.

Proactive Customer Engagement

Through predictive analytics, businesses will be able to anticipate customer needs before they arise, offering personalized solutions that drive satisfaction, retention, and long-term loyalty.

Scalable Solutions

Our platform will continue to grow with businesses, providing tools that can scale with increasing customer bases and evolving business models.

CONTACT US

Let us help you transform your customer lifecycle management

We are ready to take your business to the next level with our AI-driven solutions and advanced analytics